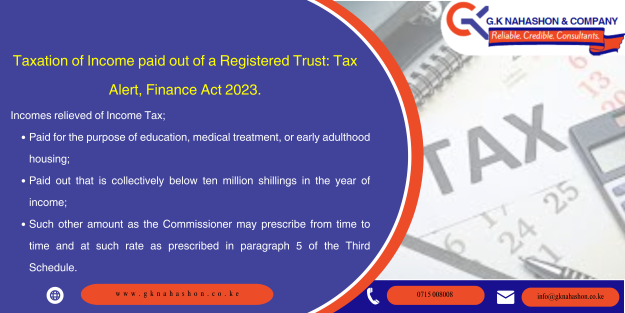

Taxation of Income paid out of a Registered Trust: Tax Alert, Finance Act 2023.

Registered Trust- Kenya

Conflict of interest between competing clients: Acceptance of engagement for Internal Auditors

After acceptance of engagement, internal auditor expectation gap, address by full disclosure for competing clients.

Tax Alert: Understand the Affordable Housing Levy (AHL) enacted under the Finance Act 2023.

Is the affordable housing levy applicable to reduce the levy contributed?

Finance Act 2023 Changes: Notice by KRA

Value Added Tax: The difference between zero rated and exempt supplies.

Zero-rated and tax exempt have no tax payable, however, there is required to file a tax return.

KRA V.A.T Case: Baitul Investment Limited-Vs-KRA

The NSSF ACT of 2013

NSSF Employer Registration: Company/ Business Download the Application Form and attach the following documents:

Corporate Social Responsibility: Its impact on business sustainability

Corporate Social Responsibility; important or made crucial by media attention to it?

Effective Internal Controls

Following the Sarbanes-Oxley (SOX) Act of 2002, it is a requirement that companies establish Internal Control Procedures and to report whether they are adequate and effective. Internal controls are the procedures and mechanisms that enhance accountability. Internal controls could enable an organization to achieve compliance, and maintain a balance between objectives, risk and performance. Although […]

Digital Asset Tax

Introduced in the Finance Act 2023 by an amendment of the Income Tax Act, inserting Section 12F. Digital asset tax shall be payable on income derived from the transfer or exchange of digital assets. The owner of a platform facilitating the exchange or transfer shall deduct the digital asset tax and remit ,within five working […]