Benefits of consistently tracking your cashflow.

- Assess liquidity.

- Assess flexibility to cover operating expenses.

- Plan for reinvestments and paying arising expenses.

Easily track your cashflow with affordable QuickBooks Online: Learn more

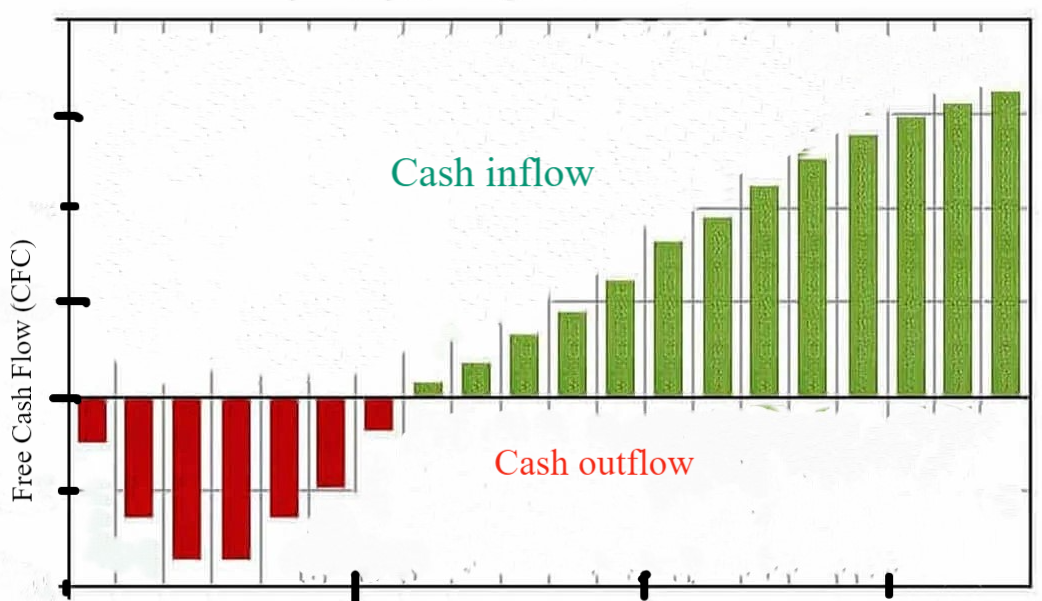

Cash flow is the movement of money in and out of the business. Assessing your cashflows helps determine the net cash flow which is a measure of the difference between cash flowing into and out of business.

Cashflow is different from revenue or profit as is determined here. It is for this reason that while the majority of SMEs already keep track of their revenue and profits (cash in the bank), they could get humongous insights in making critical financial decisions by tracking their cashflows.

Revenue is the income coming from sales. Notably, while a sale may be in cash, when it is a credit sale is accounted as a receivable. Receivables cannot be relied upon to increase your liquidity in the present because they do not actually translate into cash flow at the time of entry.

Profit referred to as net income is a measure of a business’s financial success. It is the amount of money the business makes overall over a measurable financial period after paying off all its obligations.

Cash flow on the other hand, in particular Free Cash Flow (FCF), is the cash left over after you have paid your operating expenses such as payroll, rent, taxes, and capital expenditure.

As a business owner, your cash flow is very important, more so to SMEs. Tracking your cash flow allows you to assess your liquidity in the present. You have an almost real-time visibility to your cash flow in and out of business, what line of sales (products) that are bring in cash and what operating expenses are being paid now.

Assessing your cashflow is the most effective strategy to determine whether you are making money or not. This is the reason why this process is crucial for small businesses because they rely heavily on cash inflows to cover their operating expenses and to reinvest to grow.

Positive cash flows are a better indicator of your business's financial health

Cash flow statements offer a clear view of available funds. That is why a business may appear profitable on paper, and yet lack the necessary cash to replenish inventory and cover immediate operating expenses such as leasing and utilities.

A positive cash flow is the most clear indicator that:

- Your business’s liquidity is growing.

- Your business can comfortably cover all operating expenses (rent, payroll, utility, inventory cost, marketing, insurance, step cost).

- Your business is fully capable of returning money to investors and shareholders.

- Your business is ready for reinvestment and diversification.

In conclusion, a positive cash flow for SMEs is a yardstick that definitively can determine how operationally fit a business. It is useful to the business owners, shareholders, investors, and lenders. It is only by tracking your business cash flow, that you can be certain that it has a positive cash flow.