Proposals under the Social Health Insurance Fund Act;

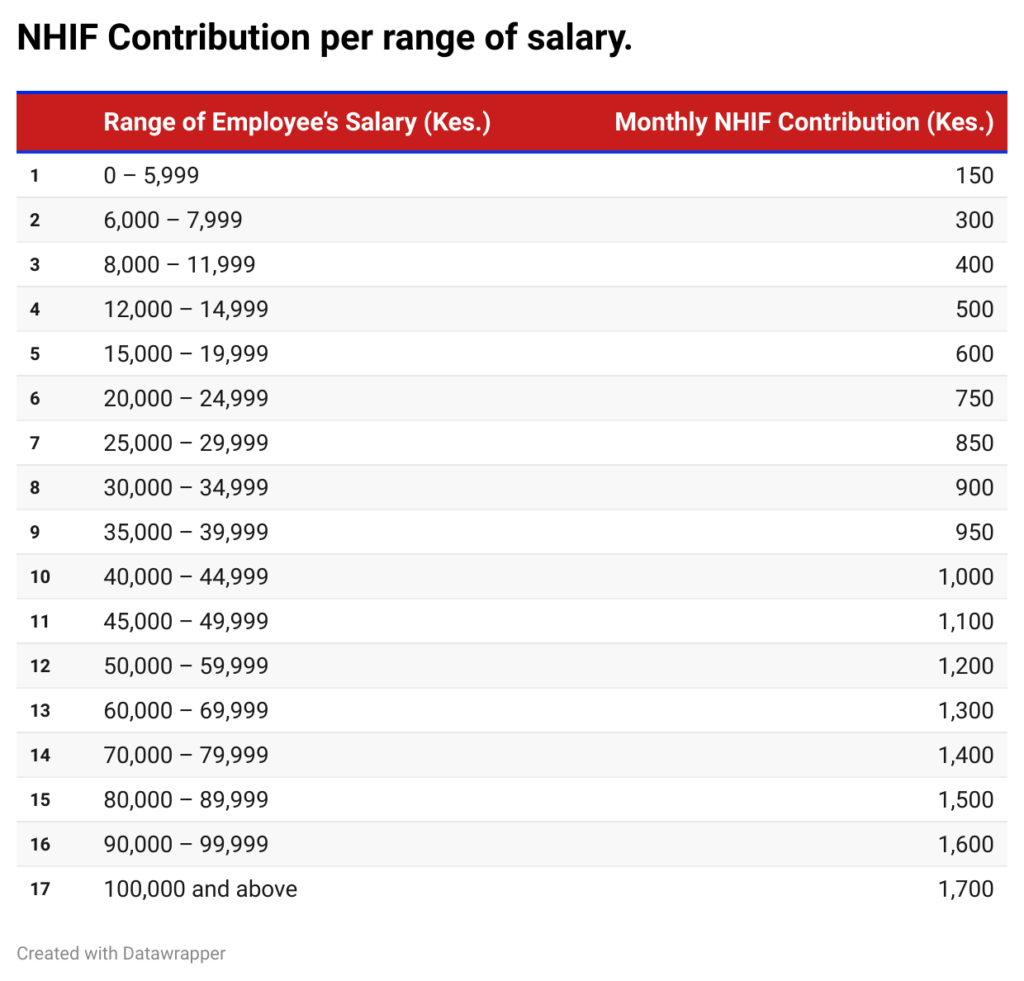

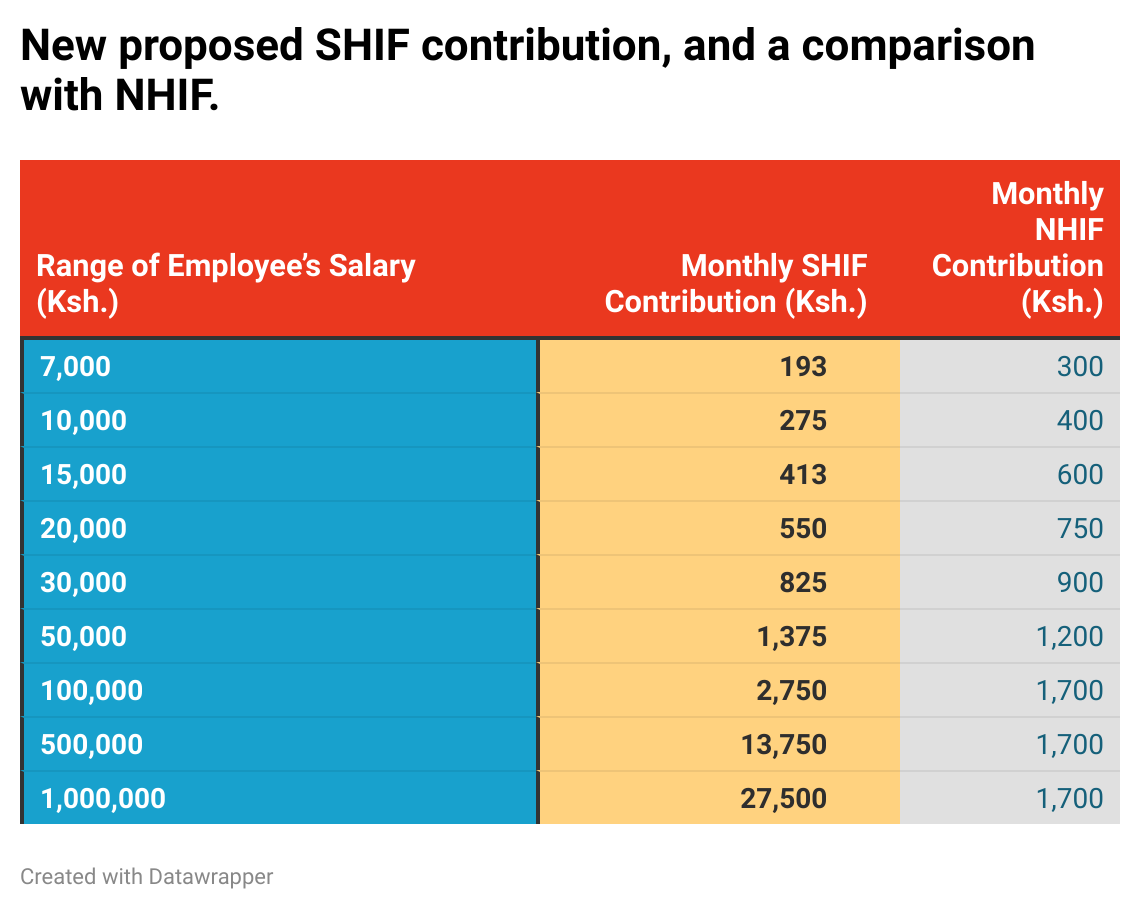

- Salaried employees to contribute a standard 2.75% of their monthly gross income.

- Self-employed individuals to contribute 2.75% of their declared or assessed monthly gross income, with a minimum contribution set as Ksh. 300.

- Unemployed individuals or those categorized as vulnerable to contribute Ksh. 1,000.

- Individuals listed as vulnerable by the State Department of Social Protection, the National Government will contribute Ksh 13,300 on their behalf.

- The waiting period for access to benefits shortened from the current 90 days to 60 days.

- Employers are mandated as usual to deduct 2.75% of the employees’ salaries and remit, non-compliance will result in penalties and interest.

Implications;

High-income earners who have been contributing Ksh. 1,700 will see a significant increase in their contribution. This increased financial burden will lead to a decreased disposable income.

Successful roll-out will lead to enhanced accessibility and affordability of health services for low-income earners.

Low-income earners will see a decline in their Monthly contributions while high-income earners' contributions will increase significantly.

Information that may be of interest;